Philip Capital mineral expert, Vikash Singh, said: “If we look at the Indian steel market, the domestic steel price is still pretty much lower than the import price. Thus, it is likely that steel prices will maintain at the current high level, or increase a little more, not decrease. Therefore, at the present time, we recommend everyone to keep the shares of companies like SAIL or Tata Steel ”.

Steel prices in China have risen to an all-time high, while prices in India have also risen sharply, following the global supply trend. From the beginning of 2021 up to now, the world steel price has increased by about 10%. Both rebar and HR coil have the strongest price increases among commodities since the beginning of the year, surpassing the price hike of iron ore. Steel prices in India have returned to the highs in January 2021. Hot rolled coil (HRC) price of India in January 2021 peaked at 57,500 rupees / ton, then dropped to 53,000 rupees in March 2021, but has now recovered back to the level as in January. The recovery of Indian steel prices in particular and Asia in general not only reinforces confidence in the sustainability of steel prices, at least in the short term, but brokerage firm Jefferies India believes that prices will continue to rise due to strong demand.

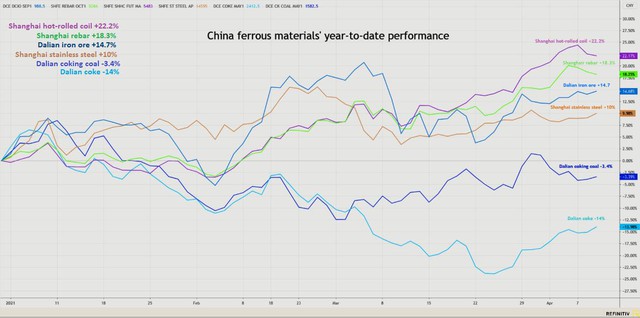

The fluctuation of iron and steel prices of all kinds from the beginning of the year to now

Regarding steel production, Sandeep Kalia, principal analyst at Wood Mackenzie, said: “The world steel industry has returned to normal levels since the second half of last year. In fact, in 2020, crude steel production of the world excluding China has dropped 8%. We see that the driving force of the global steel market comes from China and India.

Amit Dixit, an analyst at Edelweiss Institutions Equities, said steel industry prices and shares are rising, basically because the city of Tangshan (China) cut about 22 million tons of steel production this year.

“22 million tons may not seem large in the general context of the steel industry, but in terms of the steel market for shipping by sea, there is no country that can replace that 22 million tons. Also, if you look at the US and In Europe, steel prices are not only at the highest level in 13 years but also surpassing the level before the Covid-19 epidemic “, said expert Amit Dixit. According to him, with Tangshan controlling output, the supply shortage situation will continue until the fourth quarter of 2021.

According to Amit Dixit: “Steel policies are very unpredictable. If the Chinese government decides to loosen the carbon emissions issue tomorrow, steel prices will immediately fall back.”

However, Mr. Dixit does not believe that will happen, and for that quarter 2/2021 will be the best quarter in many years for steel companies.

Another factor that also makes the world steel market unpredictable is iron ore. China imports nearly 1 billion tons of iron ore every year. The scarcity of iron ore in recent years due to the Covid-19 epidemic has significantly contributed to a sharp increase in prices. But iron ore supplies are forecast to increase in the remaining months of 2021.

This week, iron ore prices on the Dalian floor (China) – the reference for the Asian market – increasing 1.2%; iron ore content 62% imported into China is still at the highest level within 1 month, 170.5 USD / ton.

“Nothing can stop iron ore prices from rebounding,” ANZ commodity analysts believe.

Resource: Cafef.vn